Running a business means having to manage a multitude of different tasks, and managing your finances can be one of the most important ones. However, when it comes to financial management, the terms bookkeeping and accounting are often used interchangeably. Are these terms synonyms? Understanding the difference will help your business.

What is Bookkeeping?

Bookkeeping is the process of keeping records of all daily financial dealings of a company in a methodical way. It builds the basis of your financial records so that every dollar that is spent or earned is noted down and documented.

Bookkeeping mainly involves:

- Documenting sales and expenditures

- Handling invoices and collections

- Payroll tracking

- Bank statement reconciliation

Bookkeeping makes sure your financial data is precise, organized, and timely, which is crucial for accounting and reporting.

What is Accounting?

Accounting is even more in-depth because it involves gaining insight from financial data and reporting it in order to facilitate and inform a business decision.

Some accounting functions include:

- Making financial statements (Profit and Loss), balance sheets, and cash flow statements

- Forecasting and budgeting

- Tax filing and tax planning

- Strategic financial analysis

To sum it up, bookkeeping involves tracking the numbers, while accounting involves interpreting the numbers to understand the financial state of your business.

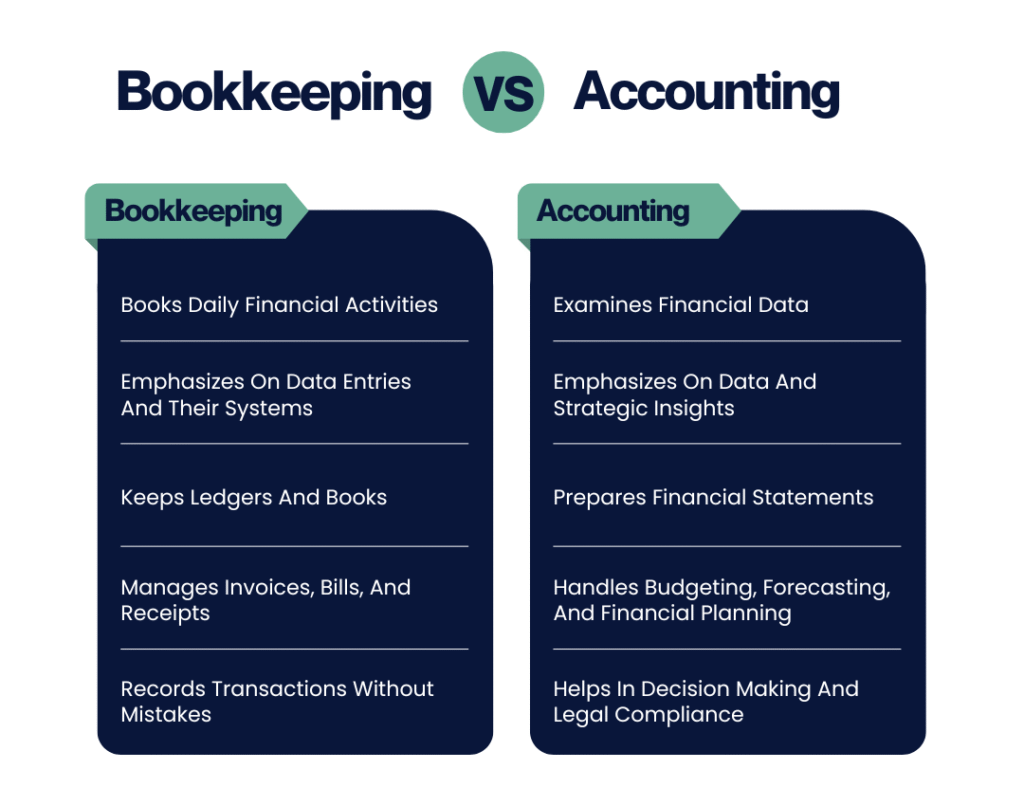

Bookkeeping vs. accounting: The key differences

In business finance, bookkeeping and accounting might seem similar, but they serve different functions. Bookkeeping is concerned with meticulous reporting of financial activities. This is recording daily sales, purchases, receipts, and payments. It helps crystallize financial information, and with its help, financial data can be organized for further analysis.

Accounting is the next step in the process, as it tries to understand and report on the information from outsourced bookkeeping. From this data, accountants design financial statements, tax obligations, and business growth and performance and give recommendations for management. In this sense, bookkeeping is routine, while accounting is analytical to help predominant decision-makers understand the number’s underlying and fundamental aspects.

Overall, accounting expresses to the business the narrative of growth and compliance after bookkeeping preserves detailed financial records. Both are essential, serving different needs for financial management: bookkeeping is to maintain the ‘scoreboard’ and accounting is to interpret the ‘game plan.’

Which One Does Your Business Really Need?

It all depends on your business’s size complexity, and goals:

- Small businesses with simple finances: You may only need bookkeeping. Keeping records helps organize your business and meet tax obligations.

- Growing businesses or those looking for more financial insight: You need accounting to make decisions, manage budgets, and plan.

In most scenarios, businesses benefit from both. Bookkeeping lays the foundation, while accounting builds the strategy.

Tools and Services to Think About

With new advancements in bookkeeping and accounting technology, consider:

- Bookkeeping software: FreshBooks, Xero, QuickBooks

- Accounting software: NetSuite, Sage, Zoho Books

- Outsourced services: Virtual bookkeepers and accountants can save you time and ensure there are no mistakes

- Hybrid services: Some companies provide bookkeeping and accounting services together

Your budget, your business, and how much detail you want will all affect what tools and services you choose.

Mistakes to Avoid

- Mistaking bookkeeping for accounting

- Missing out on small daily transactions that may cause mistakes

- Using spreadsheets without reconciliation

- Leaving tax planning to the last minute

- Not spending on the right tools or expertise

Avoiding these mistakes will make your financial management more accurate and actionable.

Conclusion

Bookkeeping and accounting complement each other perfectly. While bookkeeping keeps a record of the transactions that make up a company’s financial history, accounting takes that history and makes sense of it. Knowing the difference and combining the two properly can save you time and stress, as well as position you for growth.

From small startups to scaling companies, investing in both bookkeeping and accounting will pave the way for clearer finances and better business decisions.

FAQs

1. Can I do bookkeeping myself?

Yes, as long as you are accurate and consistent, many small business owners do simple bookkeeping with software like QuickBooks or Xero.

2. Do I need an accountant if I have a bookkeeper?

Bookkeepers and accountants each serve different, yet, equally important purposes for a business. A bookkeeper records transactions while an accountant analyzes those transactions and provides guidance. Most companies need both.

3. How often should I update my books?

At KeyCMS Accounting, we recommend that business owners update their books as frequently as possible – ideally daily or weekly. This ensures your records are always accurate, making tax reporting, audits, or financial decisions much smoother and stress-free.

4. Which is more expensive: bookkeeping or accounting?

Usually an accountant will cost more than a bookkeeper, as accounting takes more training and expertise, while bookkeeping is more basic, and therefore, less expensive.

5. Can software replace accountants or bookkeepers?

Software can take over many repetitive tasks, that being said, computers still are unable to do things like strategize, interpret, or make difficult decisions, and for that, humans are still needed.