Offshore accounting means outsourcing accounting services like bookkeeping, tax returns, auditing, payroll, and financial analysis to qualified professionals in other countries. With the worldwide transition to remote work due to increased access to cloud accounting software and collaboration tools, offshore accounting is more efficient and reachable than ever before.

In 2025, US CPA firms are increasingly turning to offshore staffing to address challenges such as increasing operational costs, labor shortages, and having to expand operations quickly without the long-term commitment of hiring full-time employees.

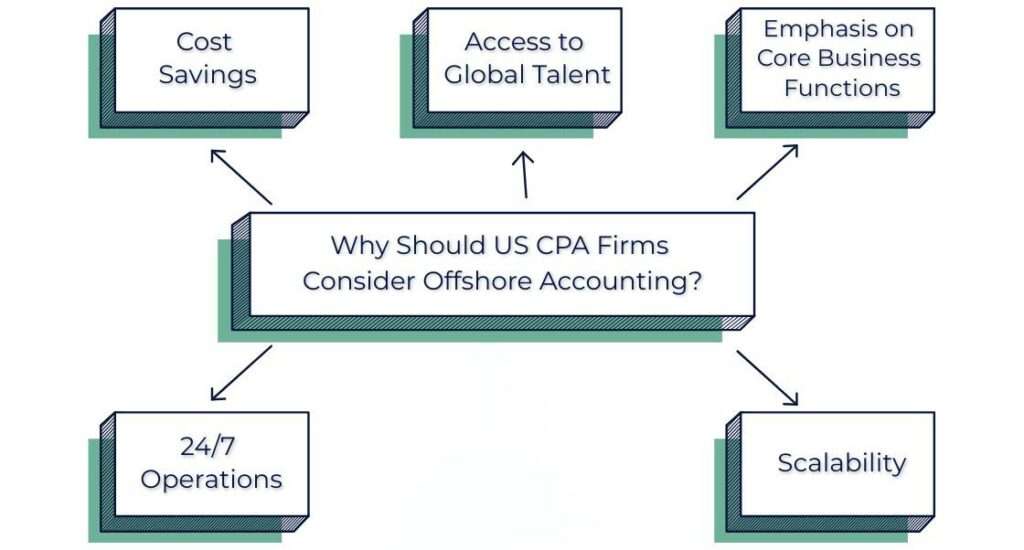

Why Should US CPA Firms Consider Offshore Accounting?

Cost Savings

Cost savings are the primary strength of offshore accounting. Outsourcing non-core functions to low-cost countries allows companies to save on overheads. Offshore accountants tend to charge a percentage of the wages of their US-based counterparts, allowing companies to redirect resources to more value-generating services.

Access to Global Talent

Offshoring staffing unlocks a worldwide pool of talent. In 2025, companies are reaching out beyond local recruitment to get access to highly qualified accounting professionals from education-driven countries in finance and accounting, such as India, the Philippines, and Eastern Europe.

Emphasis on Core Business Functions

Outsourcing regular or administrative functions, including bookkeeping and tax return filing, enables your in-house staff to concentrate on high-value client services like advisory, auditing, and strategic financial planning.

Scalability

Offshore staffing gives companies the agility to quickly scale their workforce up or down as workloads change.During peak seasons such as tax season, companies can readily augment offshore personnel to manage the workload without having to recruit full-time employees or go through staff layoffs during off-seasons.

24/7 Operations

With the ability to have teams working in various time zones, your company can work virtually around the clock. This provides quicker turnaround times, particularly when the deadlines are close, and provides your clients with uninterrupted support.

Major Offshore Accounting Tasks for US CPA Firms

Offshore teams offer a wide array of accounting services.These are the most prevalent tasks outsourced by US CPA firms in 2025:

- Bookkeeping and General Ledger Administration

- Preparation and submission of tax returns

- Processing of payroll

- Preparation of financial statements

- Audit assistance and compliance

- Accounts Payable and Receivable Administration

- Financial analysis and reporting

These tasks lend themselves particularly well to offshore outsourcing since they tend to be routine, demand technical competence rather than out-of-the-box thinking, and can be effectively managed remotely if one has the proper tools.

Top Offshore Staffing Locations for CPA Firms in 2025

A number of countries in 2025 remain favored offshoring locations for accounting services by providing an adequate combination of qualified professionals, cost savings, and time zone convenience.

India: It has a vast pool of accountants experienced in US GAAP and IFRS.India also provides huge cost savings over the US.

Philippines: Rising center for accounting outsourcing, especially for bookkeeping and tax filing. The Philippines boasts a good image for English proficiency and staff familiar with Western accounting methods.

Eastern Europe (Ukraine, Poland, Romania): Ukraine and Poland are gaining popularity as destinations for CPA firms because of their well-trained accountants and lower charges. The time difference between the US and Eastern Europe is minimal, making communication convenient.

Latin America (Mexico, Colombia, Brazil): Geographic proximity to the US, cultural affinity, and bilingual (English-Spanish) talent make Latin America a good choice for companies that want to nearshore accounting services.

United States: Domestic outsourcing offers a close-to-home solution with the advantage of no language barriers, shared cultural understanding, and alignment with US legal and tax frameworks. For firms that need to scale quickly without the complexities of offshore collaboration, it’s an ideal solution. Popular locations include tech hubs like Austin (TX) and Phoenix (AZ), where accounting professionals can seamlessly integrate into your firm’s workflow with minimal time zone or communication challenges.

Legal and Compliance Considerations for Offshore Accounting

Though the advantages are obvious, it’s essential to comprehend the legal and regulatory implications of sending accounting activities overseas. These are some essential points for US CPA firms to consider:

Data Security and Confidentiality

Working with sensitive financial information overseas necessitates thorough compliance with data protection laws. Companies should ensure employees working overseas adhere to US privacy legislation, i.e., the GLBA and SOX.

IRS Regulations

US tax authorities impose certain obligations on CPA firms to report and file accurately. Make sure your offshore staff understands the IRS requirements and can operate within the framework of US tax laws.

Contractual Agreements

It’s important to have well-drafted contracts before using an offshore staffing firm. These should delineate the scope of work, timelines, data security policies, confidentiality policies, and any non-compete policies.

Tax Laws Internationally

US CPA firms should factor the international tax considerations of outsourcing into account. Certain jurisdictions will have special tax treaties or laws that might influence the cost and delivery of services.

Tools and Technologies Enabling Offshore Accounting in 2025

Cloud accounting software and collaboration tools are the most important in executing offshore teams successfully. In 2025, some of the tools your firm should implement are:

Accounting Software: QuickBooks, Xero, and NetSuite are some of the most widely used tools for instantaneous onshore-offshore collaboration.

Communication Tools: Effective communication and team coordination require tools like Slack, Zoom, and Microsoft Teams.

Document Management Tools: Dropbox, Google Drive, and OneDrive are used to store and manage documents in a secure manner.

Project Management Tools: Asana, Trello, and Monday.com are helpful for tracking tasks and meeting deadlines.

Offshore Accounting Potential Challenges and How to Address Them

Communication Barriers

Language and time differences can make communication difficult. Mitigate this by investing in good communication tools and overlapping work hours for essential activities.

Quality Control

High standards with offshore employees need ongoing monitoring and transparent processes. Regular auditing, transparent documentation, and feedback mechanisms are necessary.

Legal and Tax Risks

Offshoring can put companies at risk of legal and tax exposure if not well managed. Collaborate with legal experts to be in line with US and global laws.

Conclusion: Is Offshore Accounting Suitable for Your Company?

Offshore accounting can be a lucrative asset for US CPA companies, providing cost savings, access to expertise, and scalability of operations. But to achieve success, they must plan well, consider the legal factors, and manage teams properly.

In 2025, with the proper tools and strategies in place, offshore accounting will be able to support your firm’s success in a more competitive global marketplace.