If you want to have a successful and sustainable company, you have to do good bookkeeping. As a small business owner, you might miss some bookkeeping elements and create very expensive mistakes that will impact your business finances and operations. Cash flow problems, incorrect financial reports, missed opportunities, and penalties are just a few of the consequences bookkeeping mistakes lead to.

In this post, we will look at the potential impact of small business bookkeeping mistakes, discuss avoidance strategies, and outline the consequences of the mistakes. Avoiding small business bookkeeping mistakes will help your business grow and avoid wasting time and money.

Mixing Personal and Business Finances

Small business owners regularly and expensively get bookkeeping wrong by mixing their business and personal finances. It may be easy and convenient to use one bank account for both business and personal transactions when just starting out, but it makes financial records unclear and inaccurate.

Unmixed business and personal finances create problems for tracking all transactions related to the business. Missing transactions lead to possible overspending and lost tax write-offs. Poor financial records lead to complicated tax returns and may raise suspicion for audits, which come with penalties.

How to Avoid It:

- Open a new account with a different bank for your business and use it only for business purposes.

- Get a business credit card, if you don’t have one already, to use for business expenses.

- Set aside a personal account that you will use only for personal activities.

Separating your finances will help you keep your bookkeeping in order, relieve some stress during tax time, and give you an idea of how your business is doing financially.

Neglecting Regular Monitoring and Reconciliation

Small business owners frequently overlook the importance of regularly checking and reconciling their finances, which is the most common cause of mistakes and financial problems. Issues such as inaccuracies, mistakes, and oversights can go unnoticed and build up over time.

Unreconciled accounts can lead financial reports to be inaccurate which can affect their business decisions. Failure to regularly monitor accounts can mask mistakes until it is too late.

How to Avoid It:

- Dedicate time each month to cross-check all accounts. This includes the reconciliation of bank statements, credit card statements, and business accounts.

- Use an automated system to simplify categorization and reconciliation for transactions.

- To keep your records accurate and current, consider the services of an accountant or bookkeeping software.

Thorough and accurate financial records give you up-to-date information and insights about your business and are a result of constant reconciliation and monitoring.

Misclassification of Transactions

Inaccurate bookkeeping can lead to serious financial and tax problems. Mistakenly categorizing expenses or income can result in financial statements that are not accurate and overpayment of taxes. For instance, consider operating expenses that are incorrectly classified as capital expenses. This will create distortion in the profit and loss statements and result in inaccurate financial reporting.

In the beginning, the misclassifications may seem like they would not hurt anything, but they can create reporting inconsistencies, tax complications, and loss of deduction opportunities.

How to Avoid It:

- Consider using professional accounting services or bookkeeping software so that your transactions can be properly classified.

- Understand the typical expense and income classifications that apply to your business.

- To spot possible misclassifications, check your financial reports on a regular basis.

The true state of your business can be captured when a business’s financial statements are accurate. This can be achieved by making appropriate decisions with the transactions at hand.

Ignoring Accounts Payable & Accounts Receivable

The effective handling of accounts payable (AP) and receivables (AR) is essential to every business’s cash flow, costing small businesses with little working capital even more. Neglecting AP and AR may lead to late payments, cash flow opportunity losses, and relationship strains with suppliers or clients.

Without accounts payable and receivable tracking, businesses face overdue bills, missed payments, a poor credit score, and cash flow tracking difficulties. Unsettled books with a business’s obligations and receivables create an even more complex financial management situation.

How to Avoid It:

- Utilize accounting software to monitor AP and AR in real time.

- Configure automated alerts for payments and reminders on past-due invoices.

- Periodically check and refresh your AP and AR to process bills and collections in a timely manner.

You can strengthen your business financially by controlling your accounts payable and receivable, avoiding cash flow issues, and evading penalties.

Failing to Track Liabilities

The financial health of your business involves the assessment of your business loans, lines of credit, and outstanding debts. Tracking these may seem cumbersome, yet the consequences of not doing this are missed payments, accrued interest, and problems with financial statements.

Poor tracking of these items may be worse than the analytical challenges of financial stress during your business. Neglecting these items also has credit rating consequences and may complicate your business during tax time.

How to Avoid It:

- Systematize your business liabilities. Don’t forget due dates, interest rates, and payment schedules.

- Check your liability balances regularly to keep up with payment deadlines.

- To manage your liabilities and avoid penalties, consulting a certified accountant may be a good option.

Organized and structured liability tracking helps you make timely payments.

Ignoring Accounting Principles & Estimates

Many small business owners overlook the importance of sticking to the basic principles of accounting, like the estimates method, and especially accrual accounting, considering that there are even more advanced accounting techniques like cash-based and accrual accounting. Knowing the fundamental principles of accounting helps with better financial reporting, and managing the right accounting principles helps create more accurate financial reports.

Furthermore, financial reports and accounting statements should include depreciation estimates and bad debts to accurately report the values of the company’s assets and liabilities.

How to Avoid It:

- Self-educate on the fundamentals of accounting or employ an accounting professional.

- Use decent bookkeeping software that adheres to accounting practices.

- Check financial estimates regularly and revise them as needed.

Considering certain estimates and principles accounting gives way to accurate financial reports.

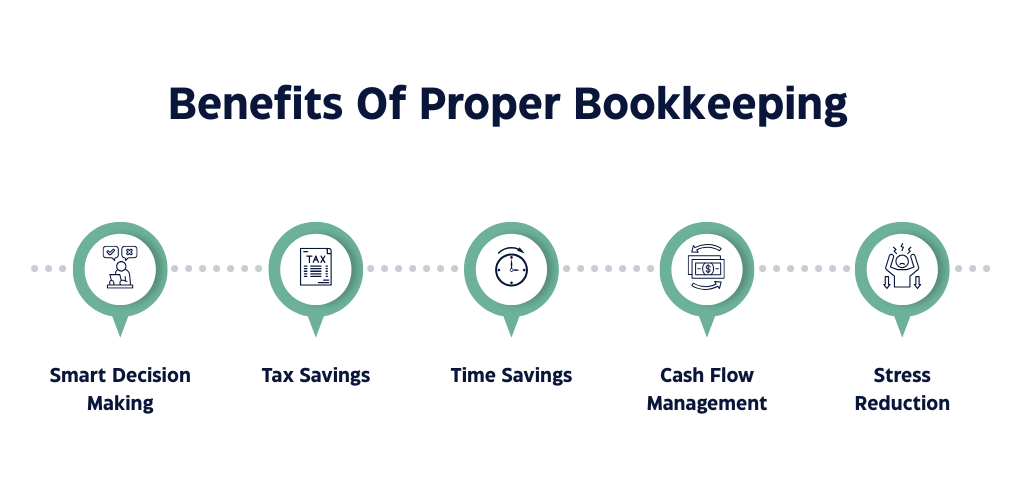

Benefits of Proper Bookkeeping

Bookkeeping management benefits small scale enterprises in various ways. Some of them are:

Smart Decision-Making: With more precise financial reports, business owners gain insights on what strategies to employ to boost revenue, what costs to cut, and what new ventures to invest in.

Tax Savings: Careful bookkeeping guarantees that tax write offs are maxed and tax burdens are minimized.

Time Savings: Bookkeeping is time saving when it is more efficient, leading to smooth and speedy financial reports, especially during tax time and audits.

Cash Flow Management: Uninterrupted cash flow is ensured when accounts payables and receivables, along with other liabilities, are closely monitored.

Stress Reduction: With no last minute scrambling and account reconciliations to do, book keeping slows the onset of the stress

Conclusion

Every small business needs bookkeeping, which is difficult and can lead to mistakes, especially while juggling many other tasks. Mixing personal and business finances, neglecting regular reviews, misclassifying transactions, and failing to track accounts payable and receivable, can be damaging, both financially and in terms of time wasted.

Good bookkeeping lays the foundation for success. The right practices can smooth operations, reduce stress, and make it easier to focus on growing the business.

FAQs

What’s the best way to track business expenses?

Business expenses can be tracked easily using accounting software like QuickBooks or Xero. Just remember to categorize expenses correctly, or else you will have misclassifications.

How often should I reconcile my accounts?

To keep data accurate, it is best to balance accounts every month to catch any mistakes.

Should I hire a professional bookkeeper?

If you do not have time to do bookkeeping or it is not something that you can do, then you could hire a professional bookkeeper as an accountant.

How can I avoid late payments?

Make sure you have automated reminders on bills and invoices. Accounting software can also help track deadlines and payment cycles.

What are some common accounting principles I should know?

There are accounting principles that are the same every time. Profit or loss accrual, consistency, and the matching principles, in which revenues and expenses are placed in the same time period.