In today’s fast-paced digital economy, businesses of all sizes are embracing virtual solutions – from remote teams to cloud-based project management tools. Accounting is no exception. Virtual accounting services have emerged as one of the most efficient, scalable, and cost-effective ways for companies to manage their finances without maintaining an in-house accounting department.

If you’re considering switching to a virtual accounting provider in 2025, this guide will walk you through what virtual accounting is, its benefits, how it works, and the best practices for getting the most out of it.

What Are Virtual Accounting Services?

Virtual accounting, also known as online accounting or remote bookkeeping, refers to outsourcing your financial management tasks – bookkeeping, tax filing, payroll, and financial reporting – to a team of professionals who operate remotely using cloud-based software.

Instead of having an accountant physically present in your office, your data is securely shared through online accounting platforms such as QuickBooks Online, Xero, FreshBooks, or NetSuite, while certified accountants and bookkeepers handle your books in real time from anywhere.

These services can include:

- Bookkeeping and reconciliations

- Financial statement preparation

- Payroll processing

- Tax filing and compliance

- Accounts payable and receivable management

- Cash flow management

- Virtual CFO or advisory services

By combining advanced accounting software with skilled professionals, virtual accounting offers a modern, flexible, and scalable alternative to traditional accounting departments.

Why Virtual Accounting Is Booming in 2025

The demand for virtual accounting has skyrocketed in recent years – especially after the COVID-19 pandemic normalized remote work and digital collaboration. As of 2025, over 65% of small and medium-sized businesses in the U.S. use some form of cloud accounting or outsourced finance management.

Key Trends Driving Growth

- Automation & AI Integration – Automated data entry, AI-driven insights, and machine learning make bookkeeping faster and more accurate.

- Remote Collaboration Norms – Businesses are now comfortable managing critical functions virtually.

- Cost Pressure & Efficiency – Inflation and wage increases have made in-house accounting teams more expensive, pushing firms toward cost-effective outsourcing.

- Scalability & Flexibility – Startups and e-commerce businesses need financial services that can scale up or down as needed.

- Cybersecurity Advances – Modern accounting platforms offer bank-grade encryption, multi-factor authentication, and data redundancy.

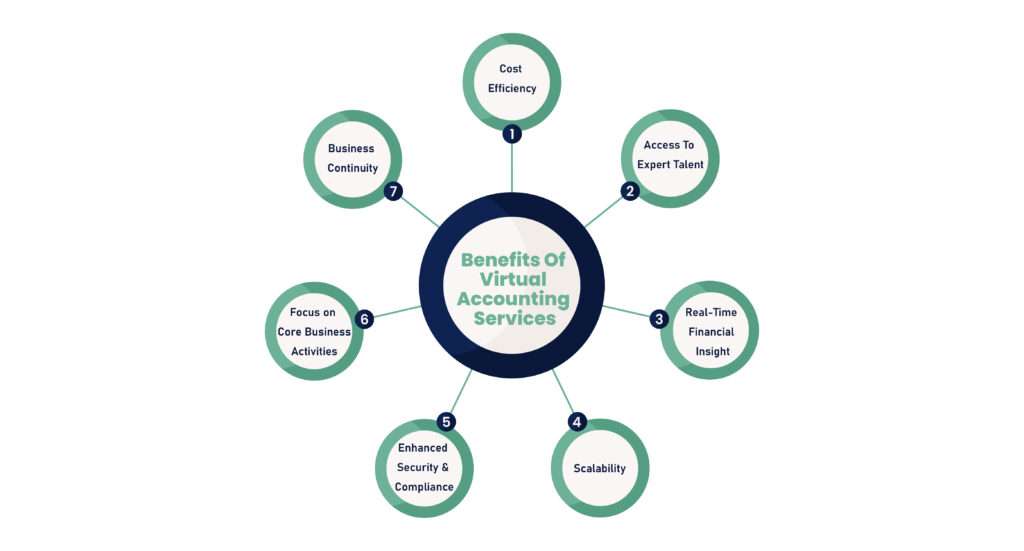

Benefits of Virtual Accounting Services

Switching to virtual accounting can transform how you manage your business finances. Here are the top benefits that make it such an attractive option in 2025:

a. Cost Efficiency

Hiring full-time, in-house accountants is expensive – especially when you include salaries, benefits, training, and software costs. Virtual accounting lets you pay only for the services you need, often at a fraction of the cost.

b. Access to Expert Talent

You’re no longer limited by geography. Virtual accounting firms employ certified professionals with expertise in various industries – from startups and SaaS to e-commerce and manufacturing. This allows you to access specialized financial knowledge without paying executive-level salaries.

c. Real-Time Financial Insights

With cloud-based accounting tools, your financial data is always up-to-date. You can access dashboards showing revenue, expenses, and cash flow 24/7 – helping you make data-driven decisions faster.

d. Scalability

Virtual accounting grows with your business. Whether you need simple bookkeeping today or CFO-level insights tomorrow, virtual providers can scale their support without forcing you to hire or train additional staff.

e. Enhanced Security & Compliance

Top virtual firms use bank-grade encryption, secure data centers, and strict access controls to protect sensitive financial data. Many also assist with tax compliance, ensuring that your filings meet federal and state regulations.

f. Focus on Core Business Activities

By outsourcing accounting tasks, your internal team can concentrate on strategic priorities – marketing, sales, product development – while professionals manage the financial details.

g. Business Continuity

Virtual accounting systems are cloud-based, meaning your financial records remain accessible and protected even in case of hardware failure, natural disasters, or team transitions.

The Virtual Accounting Process: How It Works

The process of virtual accounting is seamless and designed to keep your financial operations efficient and transparent. Here’s a typical step-by-step breakdown:

Step 1: Initial Consultation & Needs Assessment

You’ll start with a consultation where the accounting firm assesses your business model, accounting needs, and pain points. This helps determine what level of service you require – bookkeeping, tax prep, CFO advisory, or all three.

Step 2: Onboarding & Software Setup

Next, the firm sets up your accounting environment. They’ll connect your bank accounts, payment processors, and POS systems to cloud-based software such as QuickBooks Online or Xero. If you already use a platform, they’ll help migrate your data securely.

Step 3: Data Collection & Categorization

Once connected, your virtual accounting team begins pulling transaction data automatically from your accounts. They categorize expenses, reconcile accounts, and prepare monthly financial statements.

Step 4: Reporting & Review

Every month (or quarter), you’ll receive financial reports such as:

- Profit & Loss Statement

- Balance Sheet

- Cash Flow Statement

- Tax Summaries

You’ll also have scheduled review meetings with your accountant or CFO to discuss performance and make adjustments.

Step 5: Continuous Optimization

Top-tier firms go beyond bookkeeping – offering insights into cost reduction, pricing strategies, cash management, and financial forecasting to help your business grow sustainably.

Choosing the Right Virtual Accounting Partner

Not all virtual accounting firms are created equal. Before signing up, consider these factors:

a. Experience and Specialization

Choose a firm that understands your industry’s financial nuances – whether that’s e-commerce inventory accounting, SaaS revenue recognition, or nonprofit fund tracking.

b. Technology Stack

Ensure the firm uses modern cloud accounting tools (like QuickBooks, Xero, or NetSuite) and integrates with your existing platforms – such as Shopify, Stripe, or Gusto.

c. Transparency and Communication

A reliable virtual firm provides clear communication channels – regular video meetings, dedicated account managers, and prompt responses to inquiries.

d. Security Protocols

Ask about their data protection measures: encryption, access controls, backups, and compliance with standards like SOC 2 or GDPR (if applicable).

e. Pricing and Flexibility

Compare pricing models – some charge flat monthly fees, while others bill hourly or per transaction. Opt for transparent pricing without hidden costs.

f. References and Reviews

Check online reviews, testimonials, and case studies. Firms like Pilot, Xendoo, Bookkeeper360, and Ignite Spot are known for reliability and industry credibility.

Best Practices for Maximizing Virtual Accounting Success

Even with the best virtual accounting firm, success depends on collaboration and communication. Follow these best practices to make the most of your partnership:

1. Keep Financial Data Organized

Ensure your receipts, invoices, and transaction records are digital, categorized, and easy to access. The cleaner your data, the more accurate your reports.

2. Communicate Regularly

Schedule monthly or biweekly check-ins with your accounting team to stay informed about trends, risks, and opportunities.

3. Integrate Your Tools

Use integrations between your CRM, payment systems, and accounting software to minimize manual data entry and reduce errors.

4. Monitor KPIs

Track financial key performance indicators (KPIs) such as gross margin, burn rate, and accounts receivable turnover. Your virtual accountant can help build these dashboards.

5. Stay Tax-Ready Year-Round

Avoid last-minute tax panic. Ask your virtual team to maintain updated ledgers and prepare quarterly estimates.

6. Protect Your Credentials

Use multi-factor authentication and limit user access to sensitive financial systems. Always revoke access promptly for departing employees.

7. Review Reports Thoroughly

Don’t just glance at reports – understand what they mean. A good accountant will help you interpret data and make informed strategic decisions.

Common Myths About Virtual Accounting (Debunked)

Despite its benefits, some misconceptions still hold business owners back. Let’s debunk a few:

Myth 1: “It’s not secure.”

Reality: Modern accounting platforms use bank-level security and encryption that often surpass traditional on-premise systems.

Myth 2: “I’ll lose control over my finances.”

Reality: Virtual accounting actually gives you more visibility and control with 24/7 dashboards and transparent reporting.

Myth 3: “It’s only for small businesses.”

Reality: Many mid-sized and enterprise firms now use virtual CFO services and AI-powered reporting tools to streamline complex financial operations.

Myth 4: “It’s too complicated to switch.”

Reality: The onboarding process is typically quick, with full support for data migration, setup, and training.

The Future of Virtual Accounting

The future of virtual accounting lies at the intersection of AI, automation, and strategic financial advisory.

Emerging tools like AI-driven categorization, predictive analytics, and blockchain verification are making accounting faster and more reliable. By 2027, analysts expect virtual accounting services to account for over $25 billion of the outsourced business services market globally.

Businesses that adopt virtual accounting now will be positioned to leverage real-time financial intelligence and stay competitive in a data-driven world.

Final Thoughts

In 2025, virtual accounting is not just a trend – it’s a transformation. It empowers businesses to streamline financial operations, cut costs, access world-class expertise, and gain real-time insights into their performance.

Whether you’re a startup seeking reliable bookkeeping or an established company looking for CFO-level advisory, virtual accounting provides the tools and talent to scale intelligently.

By choosing the right provider, embracing cloud technology, and following best practices, you can turn your accounting function into a strategic growth engine – not just a compliance necessity.